Disclaimer: This is an independent review by BBTrading. We are not affiliated with the EA developer. This post is for educational purposes only and not financial advice.

At the request of our followers, BBTrading has taken time to thoroughly evaluate: PrizmaL Gold EA.

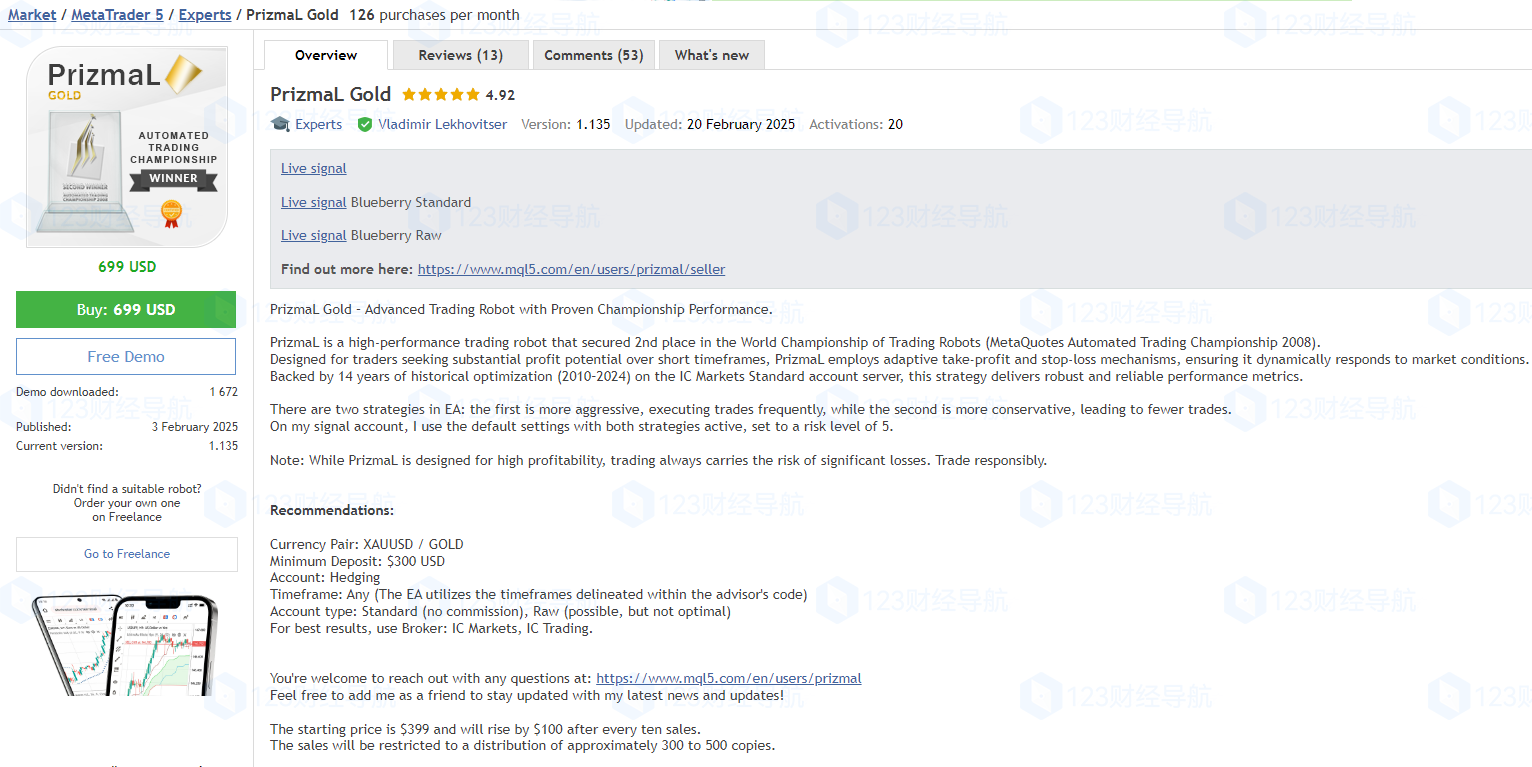

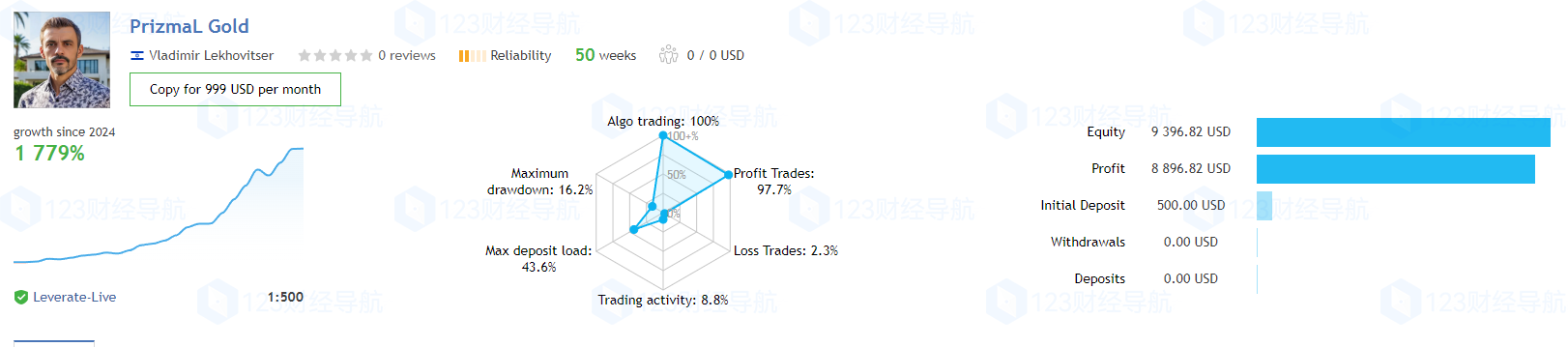

Currently, PrizmaL Gold EA ranks #1 on the MQL5 Market homepage recommendations, with the author providing live signal verification. Starting at $500, it claims nearly 20x returns in one year.

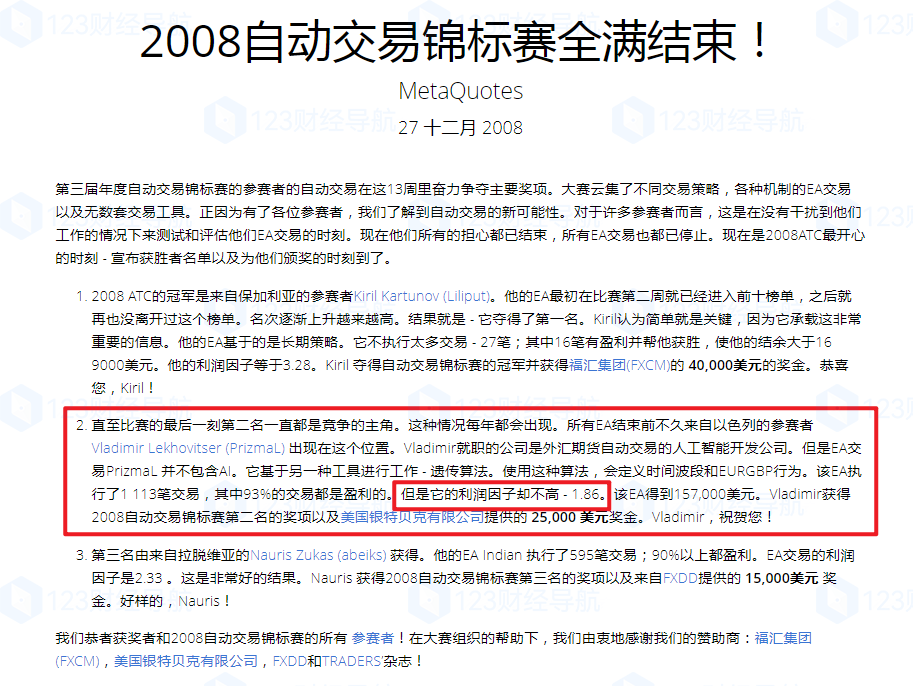

What's even more impressive: PrizmaL Gold EA secured second place in the MetaQuotes Automated Trading Championship 2008. After thorough research, we confirmed this competition did exist, and it was fiercely competitive until the final day, with a $15,000 prize difference between first and second place! The author ultimately took second place, though at that time they were primarily trading EURGBP, not gold.

From this information, BBTrading has formed an initial impression:

The PrizmaL Gold EA developer has approximately 20 years of trading experience, is proficient in coding, and has a unique understanding of high-frequency scalping - one of the earliest talents who understood both strategy and quantitative methods.

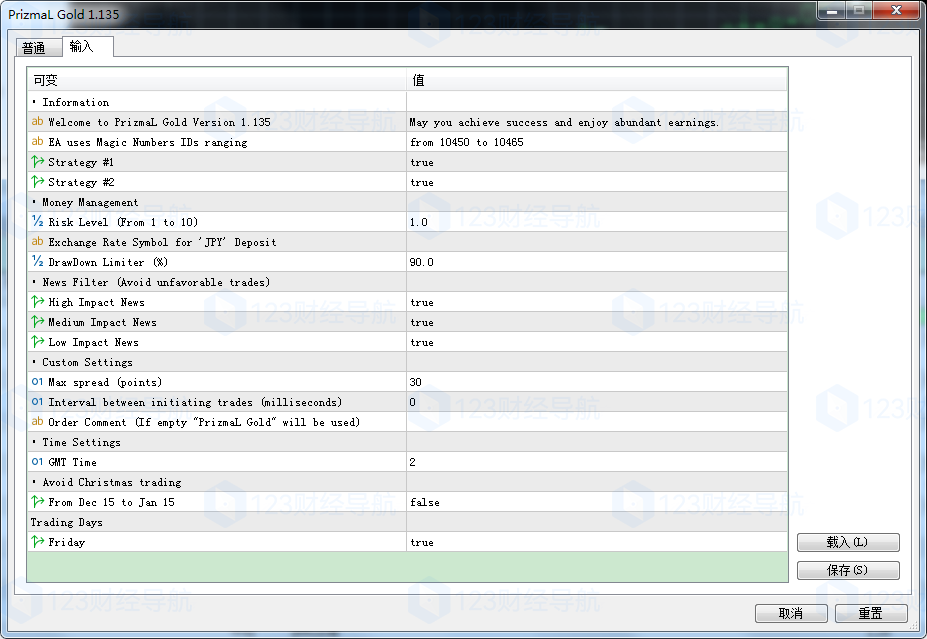

The parameters are divided into 5 modules: Basic Information, Money Management, News Management, Custom Settings, Server Time, and Trading Restriction Periods.

The magic number is hardcoded and doesn't need modification: we can deduce this is because multiple strategies are built-in, requiring independent position management.

There are two main strategies we tested: one on M1 timeframe and one on M30, though there's actually a third on M3.

Max Spread: modifications are ineffective as the author has hardcoded the upper limit in the code, with maximum spread set at 50 pips.

Other configurations are less important, as the author has built in profit/loss controls. As an experienced trader and programmer, the author has kept the logging very clean - brokers won't see any traces of order modifications, as everything is virtualized.

**BBTrading Summary**: The EA is positioned as a multi-strategy, multi-timeframe gold scalper.

In the parameters, there's a section: RISK LEVEL (1-10), which is essentially a compound interest switch. The author's live account uses level 5, with other settings at default.

### 1. How does spread, crucial for scalping strategies, affect PrizmaL Gold EA?

The author's main signal platform is Leverate, which initially puzzled us. Why Leverate?

Those outside the industry might not know, but those who've researched setting up their own platforms likely know Leverate is a broker solution provider. Leverate has previously addressed retail brokerage business matters.

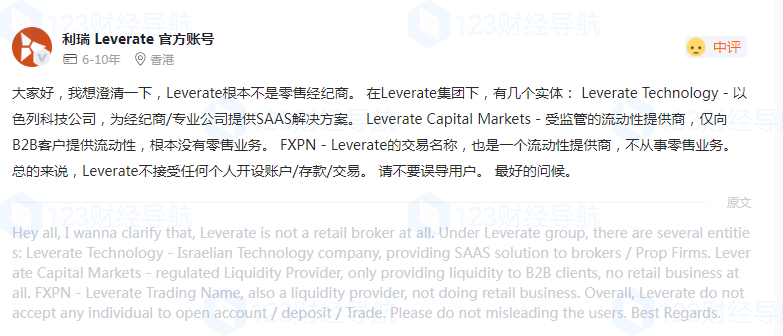

So, we don't understand how this Israeli author obtained a Leverate account, especially since Leverate-live has extremely low gold spreads, and according to MQL5 data, no platform has lower average slippage than it.

The author may have noticed these questions, subsequently setting up signals on a new platform with two account types: one with raw spreads and one with standard spreads. By comparing profits, BBTrading found approximately a 6 pip difference between them.

Since these two signals are relatively new, we can't yet determine the impact of spreads, so we'll temporarily assume the spread impact is relatively weak.

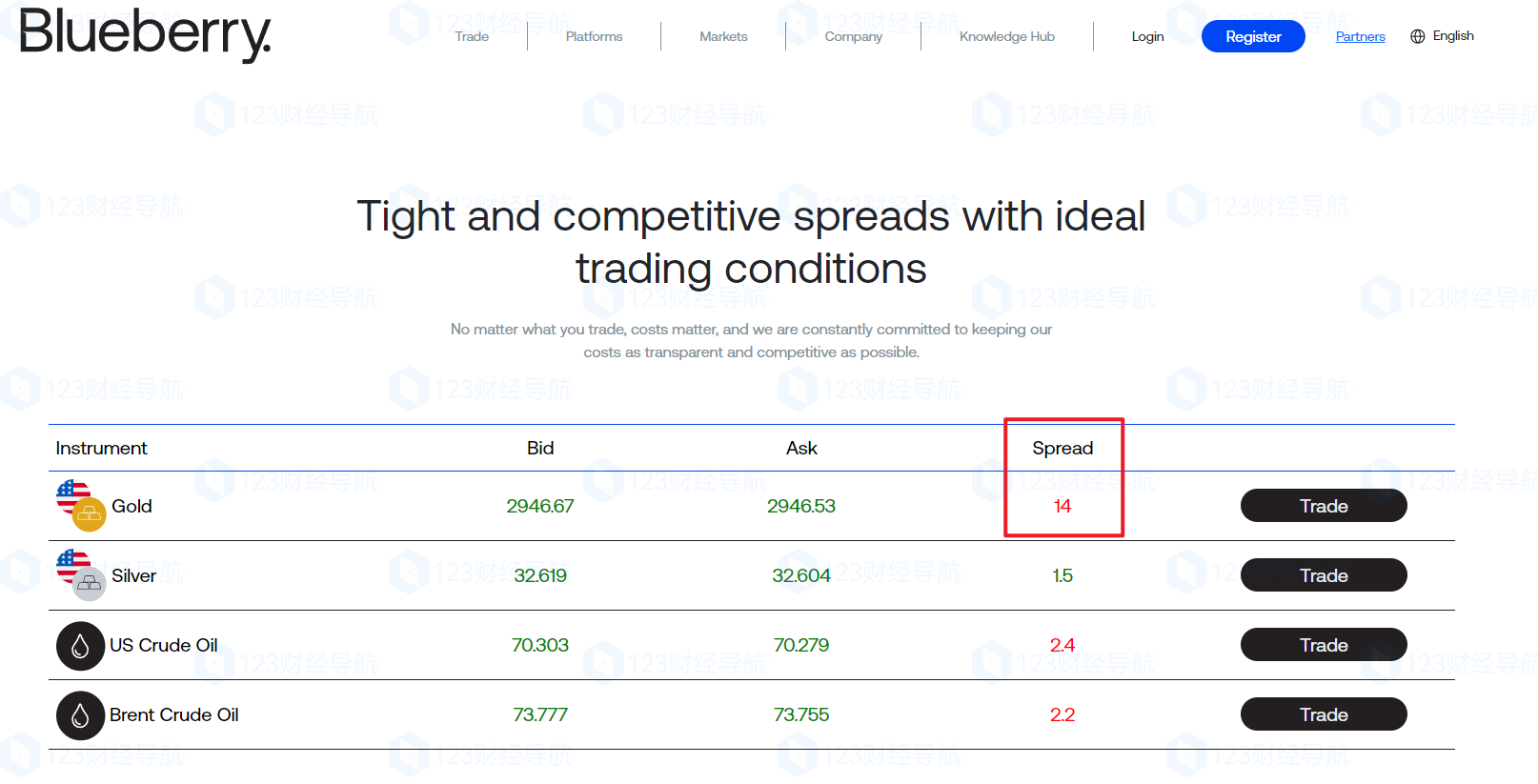

Based on our analysis, PrizmaL Gold EA executed 348 orders in the past year, with only 8 losing trades. Remarkably, 345 were long positions and only 3 were shorts - not many trades overall, with a clear long bias. The maximum profit/loss ratio exceeds 5:1, while the average profit/loss ratio approaches 1:10, with a recovery factor of nearly 9.

At this point, BBTrading can confirm two things:

1. This EA's entry points have been 100% fine-tuned

2. We need to review how this EA performs in downtrend markets

### 1. Strategy 1 Backtest

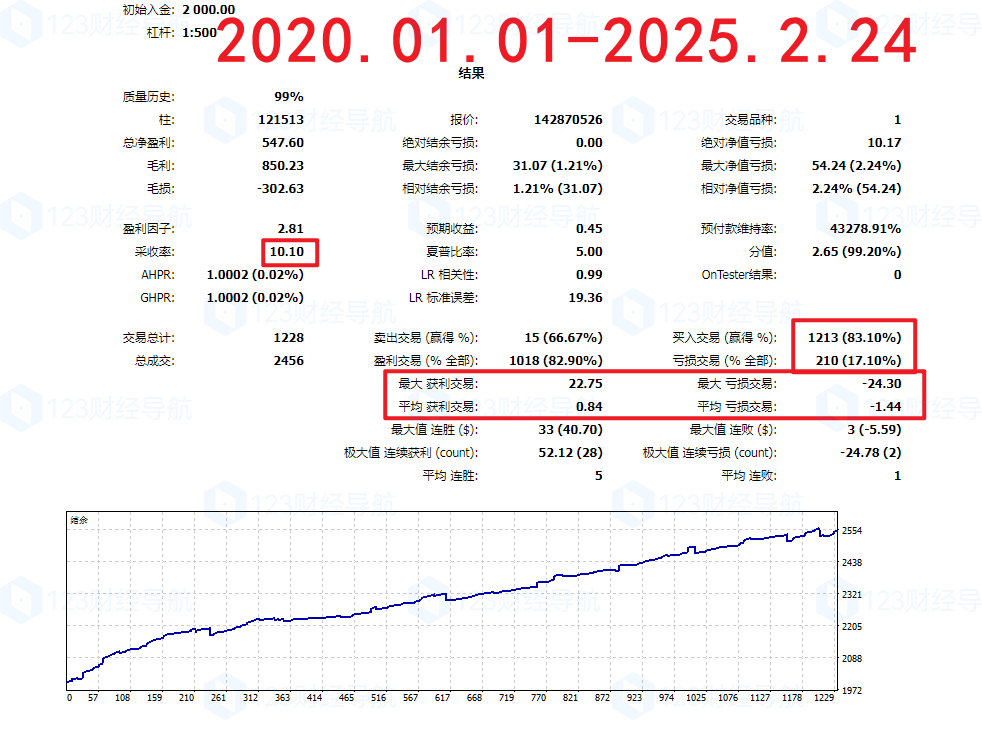

Our backtest covers gold from January 1, 2020, to present. Strategy 1 uses the M1 timeframe. After removing compounding and using a fixed 0.01 lot size over the past 5 years, the cumulative profit was $547, with an average profit per trade of $0.44. The maximum equity drawdown was $54, with a win rate of nearly 83%, and both Sharpe ratio and profit factor were impressive.

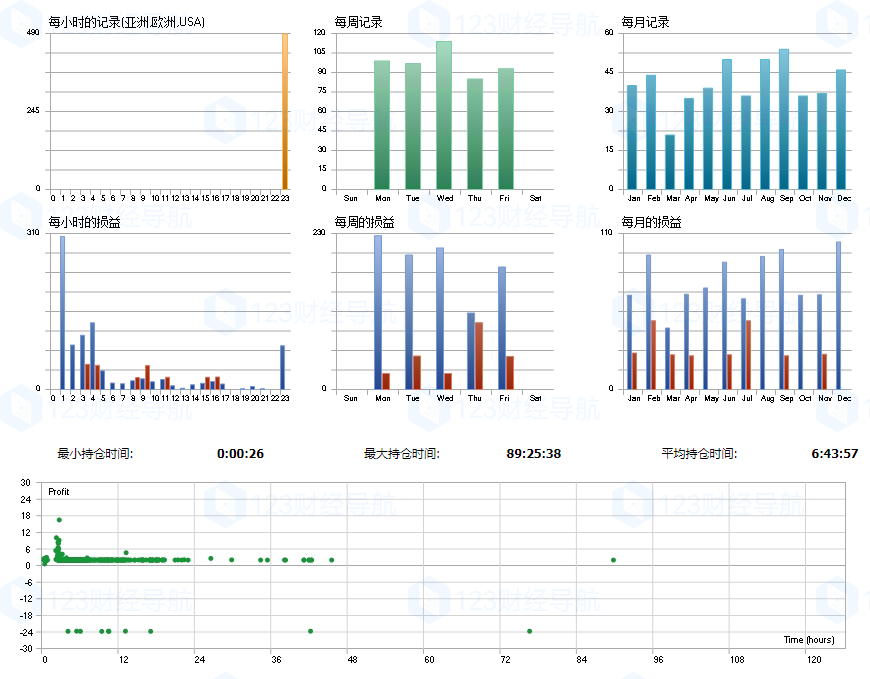

Our analysis shows Strategy 1's entries concentrate at 23:00, which converts to 5:00 AM Beijing time, with many take-profits occurring within 1 hour after entry.

**Summary**: Strategy 1 enters at 5:00 AM Beijing time, trades on M1 timeframe, with Monday take-profits having a much higher probability than other times.

### 2. Strategy 2 Backtest

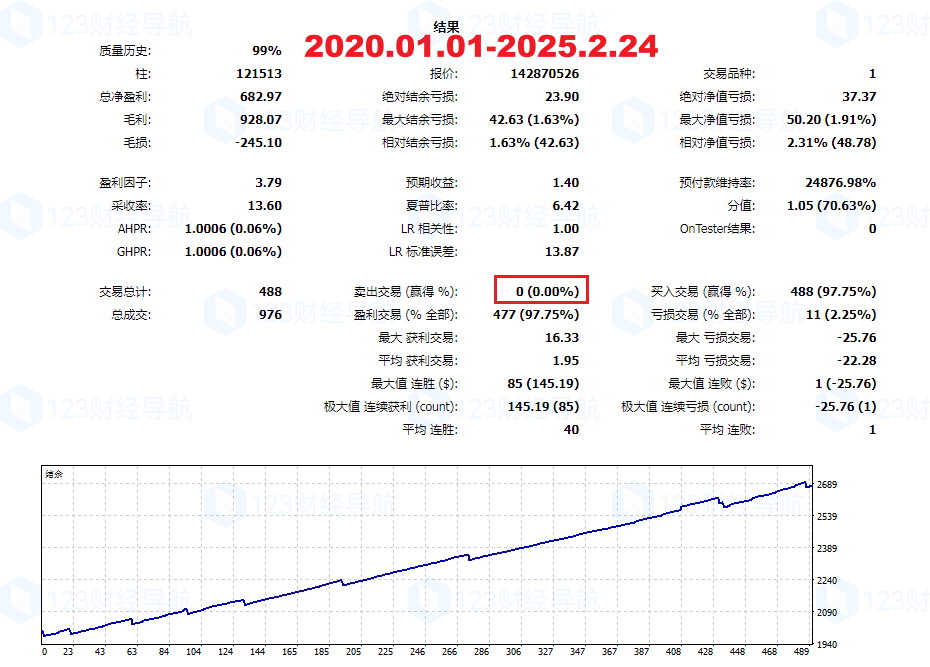

Our backtest covers gold from January 1, 2020, to present. Strategy 2 uses the M30 timeframe. After removing compounding and using a fixed 0.01 lot size over the past 5 years, the cumulative profit was $682.97, with an average profit per trade of nearly $1.40 - about 3 times that of Strategy 1. Notably, there wasn't a single short position - this is a long-only strategy. The maximum equity drawdown was $50, with the maximum single loss also predetermined. The win rate is an astonishing 97.75%, with strong Sharpe ratio and profit factor. Strategy 2 significantly outperforms Strategy 1.

Our analysis shows entries still concentrate at 23:00, and even more impressively - in the past 5 years of Strategy 2, there have been no losses at 23:00, 01:00, or 02:00 the next day. Furthermore, in the past 5 years, May, August, October, and December have seen no losses!

**Summary**: Strategy 2 enters at 5:00 AM Beijing time, trades on M30 timeframe, with much better entry control than Strategy 1. Achieving zero losses in 1/3 of the months in a year, and zero losses during 3 concentrated take-profit periods throughout the day, this entry timing control is worthy of the 2008 championship runner-up title.

### 3. Strategy 1-2 Supplementary Information

Through further investigation, BBTrading discovered another entry timeframe, M3, which opens positions rarely - only 14 entries in the past 5 years, suggesting stricter entry conditions. So, this EA has a total of 3 entry timeframes: M1/M3/M30, with M1 serving as an active supplement and M30 for deeper analysis. Additionally, we can provide 2 more pieces of information:

1. If PrizmaL Gold EA opens a position at 23:00 and takes profit within 30 minutes, the EA will continue to open new positions. If the take-profit time is still within 23:30, the EA will continue opening positions until a take-profit occurs after 23:30, at which point it stops opening new positions. This explains how multiple profits can be generated within a single day.

2. How do some single trades achieve profits of over $20? This happens when positions are held overnight and there's a gap up at the next day's open! As for losses of over $20, these can be from reverse gaps or entry errors where the EA eventually activates its stop-loss.

As an Israeli veteran trader and programmer, the author has a deep understanding of scalping techniques. By optimizing entry timing to perfection, achieving a win rate approaching 98%, there's no need for martingale support. No matter how skewed the profit/loss ratio might be, as long as luck isn't truly against you with several consecutive stop-losses, the author can recover profits and even multiply them several times through position sizing.

However, precisely because of the skewed profit/loss ratio, it ultimately can't escape the need for lot size support. When lot sizes increase, profits become substantial, but there's always the concern of that 1%-2% loss rate. The larger the capital, the larger the loss - this is the reality many trading strategies can't escape. Additionally, we must guard against spread expansion; in today's trading environment, gold spreads drifting above 50 pips is not uncommon.

Therefore, this strategy is suitable for smaller capital, which has preset loss limits, and with good luck, the possibility of multiplying several dozen times exists. For larger capital, however, the 1%-2% error rate and the 1:10 profit/loss ratio make it difficult to use with peace of mind. This is the real reason why the author's signal sources all start from a few hundred dollars.

---

*Follow BBTrading for more EA reviews:*

*Twitter: @BBTrading123*

*Telegram: https://t.me/ForexEA_XposeMQL5*

*© 2025BBTrading. All rights reserved.*

删除后无法恢复

删除后无法恢复